What The U.S. Election Can Teach Us About Sustainability

The 'What's In It For Me?' Edition

A quick heads up: This isn’t going to be a super rosy 8th edition of ‘Honey Drops’.

Nor is it an attempt to spin the election result as a long-term win for corporate sustainability. In fact, Associated Press has already released an article outlining the changes the new Administration is likely to implement to U.S. Climate policy, which you can read here.

However, even in the first 46hrs since the winner of the election first became clear, a roadmap has been provided to accelerate the race to net zero by building larger coalitions through simple storytelling tied to economic issues.

I’ve included links to articles and podcasts I have found insightful in the past couple of days at the end of today’s edition as well.

I’m looking forward to hearing your thoughts on the below, along with what’s currently on your mind at the moment. As always, share this with your people who you know will appreciate it.

Three Thoughts From Me

‘What’s In It For Me?’ Pt. 1

“It’s The Economy, Stupid” - James Carville, Lead Strategist for 1992 Presidential Candidate Bill Clinton vs incumbent President George H. W. Bush.

The 2024 Election came down to a simple question lifted straight from Ronald Reagan’s successful 1980 campaign: ‘Are you better off today than you were four years ago?’

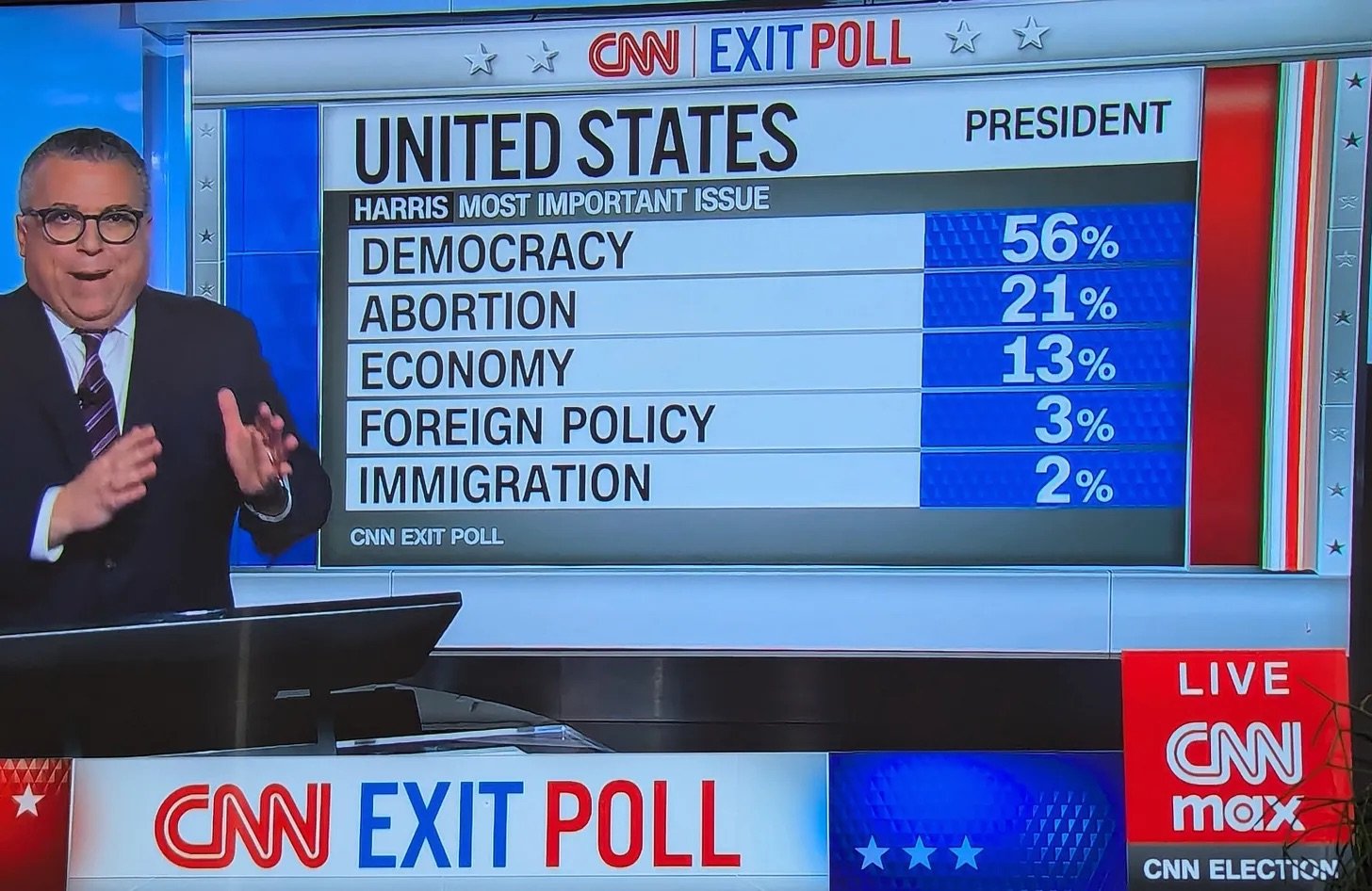

Per CNN’s exit polls, the majority of voters (across both the electoral college and the popular vote) answered ‘No’, based on the economy and immigration:

These two factors were weighted higher than the former President’s first term, his handling of Covid in 2020, the subsequent inflation sparked by supply chain disruptions and the Fed’s monetary policy. I’m sure there would be a pretty interesting Venn diagram of U.S. voters who were against lockdowns, mandatory masks etc. and those now decrying the state of the economy.

They were also weighted above the overturning of abortion rights, threats to democracy and foreign policy.

Sustainability Lesson To Take Away: Follow The Money

This boils down to these four questions for Sustainability teams:

What commercial deliverables are most important to your stakeholders?

How are they incentivised to hit their targets/bonus?

Which of their pressures are most acute?

And what can Sustainability do to release these pressures for them?

‘The Goodness Of Your Heart’ Argument Always Has, and Always Will Be, A Non-Starter

‘What’s In It For Me?’ Pt. 2

The election has shown that no matter whether it will result in the first female President, the first woman of colour President, or the first President aged under 70 to be sworn in since 2012, ‘easy fixes’ to financial pressures come out ahead of the better angels, every time.

Sustainability Lesson To Take Away: Balance Sheet > the ‘Right Thing’

While there are inherent biases within the electorate (evidenced by the swings towards Trump even in high-income counties across the U.S. within the 24% who experienced ‘no hardship’ and have had hugely profitable years under the current administration), unfortunately, we know these same biases often exist within organisations as well. This means that revenue growth, shareholder returns and insurance premiums has to be the language of Sustainability for us to be effective messengers.

As the CEO of Ford, Jim Farley, says: “You never want to be on the wrong side of customers and what matters in their lives.”

Which is just as true for internal stakeholders.

As I discussed a couple of weeks ago in The Future Has Arrived re: the impact any disruptions to the Straight of Hormuz will have on world oil prices, switching to Renewables, for example, provides organisations with clear and attractive commercial opportunities.

Renewables are now delivering consistent reductions in the cost of production, and we already know that their usage:

Generates competitive advantages for winning new clients/customers

Provides stable fuel pricing for financial modelling

Unlocks access to government tendering opportunities, rebates and large-scale generation certificates (LGCs)

Decentralises energy sources, hedging operational exposure to disruptions

Reduces overall energy usage via energy efficiencies across the business, all while reducing operational carbon emissions for businesses and their value chains.

Which is not just a stronger argument in real-time than: “We need to reduce our carbon emissions because it’s good for the planet/your children/grandchildren”, but also one that is much more likely to have a material impact due to being funded by the CFO, CEO, Managing Director, Chief Operating Officer or Chief Risk Officer, depending on your reporting line.

I’ve even seen this commercial argument result in access to multiple buckets of funding by highlighting the org-wide benefits of action.

This Journey Ain’t Easy, Straightforward or Painless

‘What’s In It For Me?’ Pt. 3

There’s real hurt being felt in many areas of the U.S. as Harris supporters come to terms with the “Vibes Election” that wasn’t. For a campaign often praised for being disciplined and on-message, it was evidently the wrong message for the key stakeholder: the voters.

And so, another data point is added to the global trend of incumbent post-Covid, high-inflation economy governments being replaced, often by populist challengers promising quick fixes to complex problems when voters don’t feel like they’re being listened to.

Sustainability Lesson To Take Away: Stakeholder Engagement

One of the key areas successful Sustainability teams have mastered is Stakeholder Engagement. People within the organisation often span the gamut from wanting to do everything possible to ensure their organisation only has a positive impact on the environment, through to those who believe climate change is a hoax.

The ‘goodness of your heart’ argument isn’t beneficial for either end of this spectrum, as the proponents for all-action can end up unable to correlate inputs with outcome and therefore lose funding sources, while the resistant team member can harm the company’s growth trajectory by not identifying material commercial risks or opportunities presented by climate change.

Especially if they’re in the Executive leadership team or on the Board.

However, meeting people where they are, understanding their problems, along with their incentive/bonus structure, is the key to ensuring a whole-of-business approach to Sustainability. This way, it isn’t deep down the priorities list, off the side of someone’s desk, or an ‘initiative’ to be cut from the budget if extra fiscal savings are required.

2 Quotes From Others

“The tipping point we’re working toward will come not from regulators who push us or from politicians who try to hold us back. It will come from consumers. Not when an arbitrary market share is reached, but when electric vehicles are simply better for more customers – better to drive, cheaper to own, and easier to integrate into daily life. This is the reality for millions already.” - Ford CEO, Jim Farley, in June.

Source: ‘Confessions from a lifelong Petrol Head. I love electric vehicles and it has nothing to do with politics’. It’s worth reading his whole post on LinkedIn to gain a first-hand look into his customer-centric business strategy.

“No matter what Trump may say, the shift to clean energy is unstoppable and our country is not turning back.″ - Gina McCarthy, Biden’s first national climate adviser and a former EPA administrator.

1 Thing For You To Ponder

I know many of us who work in the climate and corporate sustainability space experienced a sense of disbelief as the election results became clear.

The U.S. is the largest economy in the word, is responsible for ~13% of global emissions and has played a leading role in the global climate movement towards net zero by 2050. What happens nationally has outsized weight on a global scale.

However, during my time living in Washington D.C. from 2017 to 2020, I was fortunate to witness first-hand the states and cities doubling down on their Paris Agreement commitments despite the federal government’s withdrawal, and I expect no different this time around as they are poised to leave again.

If anything, the commercial implications for the U.S. economy of such a withdrawal are even greater, considering the integration of the Inflation Reduction Act of 2022 into industries across the country, and particularly in Republican-majority states, which you can see on the map below.

$130 billion in government funding has already been dispatched across five major sectors in 40 states within 342 projects, including Clean Vehicles, Solar, Battery Storage, Wind and Grid Electrification, creating more than 113,000 new jobs alone in less than two years to ensure the workforce is retraining for this century’s labour requirements.

I say all of the above to illustrate this: the climate doesn’t look at elections, it doesn’t evaluate which political party promised what, and it definitely won’t take a few years off from it’s current trajectory of greater intensity weather systems because some think it a hoax.

But it does have real-world impacts on businesses’ ability to operate profitably.

What climate change does demand is coming back from the brink of a planet that is no longer fit for us. For that, we need to tap into continuous human ingenuity and resilience.

And we have that in spades. Starting with us.

Those resources for you I mentioned:

The Guardian: ‘Donald Trump can’t stop global climate action. If we stick together, it’s the US that will lose out’

Outrage + Optimism Ep 270: What Does The Trump Presidency Mean For Climate

Wired: ‘Trump Won. What Will Happen to Electric Vehicles?’ (Jim Farley’s quote came from this article)

Until next week,

Dan