Climate Action Week Sydney is BACK!

Share your knowledge, find your tribe and build Collaborative Advantages

This is the eleventh edition of Honey Drops, a curated view of what’s been happening around the Corporate Sustainability world each week.

As The Ocelli Group takes its name from the bee's ocelli, those remarkable eyes that guide its flight via the sun, I felt it a natural extension for this Corporate Sustainability newsletter to incorporate their nectar’s alchemy: Honey.

Feel free to forward on to anyone you think would benefit from a drop on their toast or a stir in their tea.

3 Thoughts From Me

Climate Action Week Sydney 2025

After an incredible inaugural outing in May, Climate Action Week Sydney is back to put Australia on the world Climate map. I’m excited to again be part of the organising team and I’ve already noticed a large uptick in the number of companies wanting to be involved this year. My hunch is it’s a combination of last year’s success (snapshot below), and Group 1 companies for mandatory climate reporting being more comfortable sharing their progress to date, backed by the data they are now required to have.

CAW.SYD ‘25 is open to everyone, and we’re seeing some incredible Expression of Interests to plan and host events come through the door. I’d encourage you to think about what events you would like to host, as last year was an explosion of innovation, information and collaboration amongst people from all walks of life.

Event EOIs can be submitted here, Sponsorship EOIs can be registered here, and anyone can volunteer to help with planning or during the week. I'm happy to put you in touch with the right people if you send me a message.

The first round of Event EOIs close 14th Dec, so while the U.S. is spending today celebrating Thanksgiving, get your thinking cap on and get involved!

Credit: CAW.SYD 2024 Impact Report

Building The Business Case For Sustainability

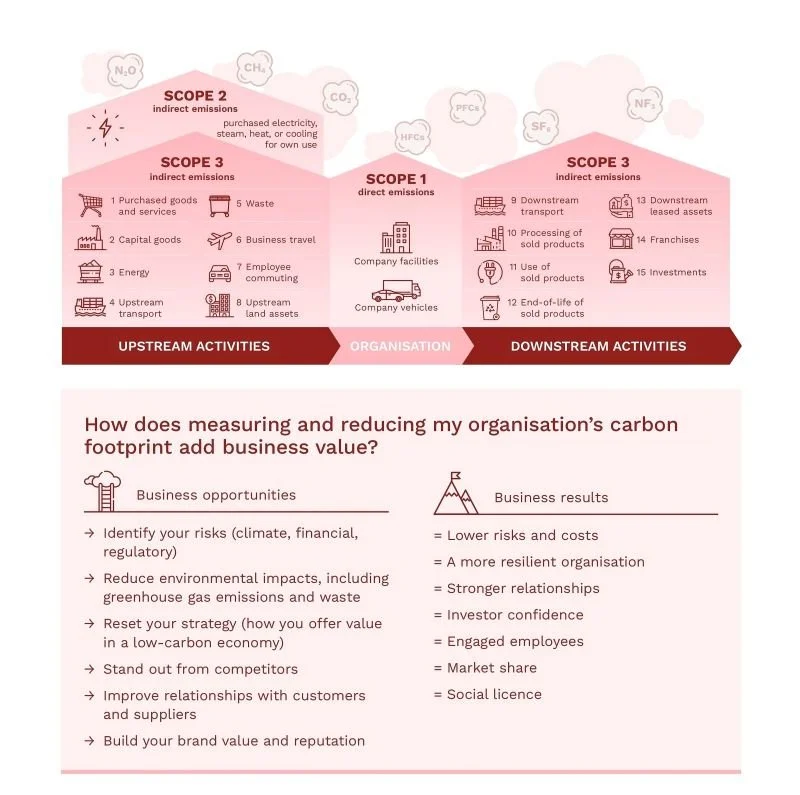

As more companies become aware of their mandatory climate reporting responsibilities under the new Australian Sustainability Reporting Standards, there’s a lot of threads being pulled that open up a tapestry, so to speak.

The below infographic is one the best illustrations I have seen to communicate with Boards and Executive teams why Scope 1, Scope 2 and Scope 3 emissions are not only business risks to be mitigated, but also commercial opportunities to be realised in the transition to a low-carbon economy.

The companies who have been proactive with their carbon management are already reaping the financial benefits, de-risking their supply chains and increasing their market share.

Let me know if you’re in the midst of this thread-pulling and we can discuss who you should be speaking with to make it a smoother process.

Credit: Antonio Vizcaya Abdo

COP29 x G20 = Climate Finance

COP has come to a close for another year and as usual, there seem to be as many competing takes on its level of success as there are countries in attendance (that’s 197 for those playing at home). And as usual, it all comes back to cash.

Without drilling down into the footnotes of policy, here’s an example of the spectrum of interests distilled into the finalised COP29 Communique.

Under the Paris Agreement, Developed economies are focused on transitioning to a renewables-first economy. We see this conversation/debate/argument continue to play out within many Western democracies as either a major factor in countries’ ability to achieve their Nationally Determined Commitment, or a sham policy that will result in rolling blackouts. I’m sure you’ve read enough of these articles that I’ll leave this for another edition.

The key point is the entire conversation revolves around the Energy Transition: how much will it cost, how long will it take, where are the best solar/wind farm locations, which farmers love/hate the new technology.

But Developing countries aren’t talking about the Energy Transition for their economies.

They are talking about the Electrification of large areas for the first time.

This presents enormous commercial opportunities for their economies, industries, manufacturers, suppliers and local communities. These countries are demanding access to the capital flows from financial markets, at comparable interest rates to those offered in Developed countries, in order to be able to take advantage of the capacity acceleration in renewables technology of the past ten years.

And as the countries most acutely experiencing the real-world impacts of climate change, the capital is also required to proactively construct adaptation measures as well as the loss and damage experienced. Hence the deep emotions evident over the past week as these negotiations have been held.

The agreed amount is USD $300 billion dollars annually by 2035, a tripling from the current USD $100 billion per year, but still well short of the level of investment needed. In fact, in an inflationary environment, the real increase is likely to be less.

This is where the G20 plays a key role in creating the systems and frameworks for private capital flows to be increased, deliver regional economic growth, reduce migration flows, reduce carbon emissions to net zero and keep global temperatures below a 1.5°C increase on pre-industrial levels:

“Leaders of the world’s largest economies have also committed to driving forward financial reforms to put strong climate action within all countries’ reach. This is an essential signal in a world plagued by debt crises and spiralling climate impacts, which are wrecking lives, disrupting supply chains, and fuelling inflation in every economy.”

Simon Stiell

Executive Secretary of the UN Framework Convention on Climate Change

2 Quotes From Others

Climate Risk is Financial Risk

The Climate Action 100+ Net Zero Company Benchmark assesses the progression of 170 major corporate greenhouse gas emitters towards net zero, focusing on emissions reduction, governance, and disclosure.

Here are the findings from their 2024 Results (thanks to Tim Prosser for sharing this with me):

90% of all companies assessed continue to disclose evidence of Board-level oversight of the management of climate change risks.

88% of companies are publicly committed to implement the recommendations of the Task Force on Climate related Financial Disclosures (TCFD) OR International Sustainability Standards Board (ISSB) Standards.

80% of companies have set an ambition to reach net zero by 2050 or sooner on at least Scope 1 and 2 emissions. This is up from 51% in the first Benchmark assessments (March 2021).

Source: Climate Action 100+ Net Zero Company Benchmark 2.1

Clearly still a long way to go and with much of the heavy lifting in front of them, but trending in the right direction while sending clear market signals to their supply chains, which is the level of outsized effect required to transition industries and economies.

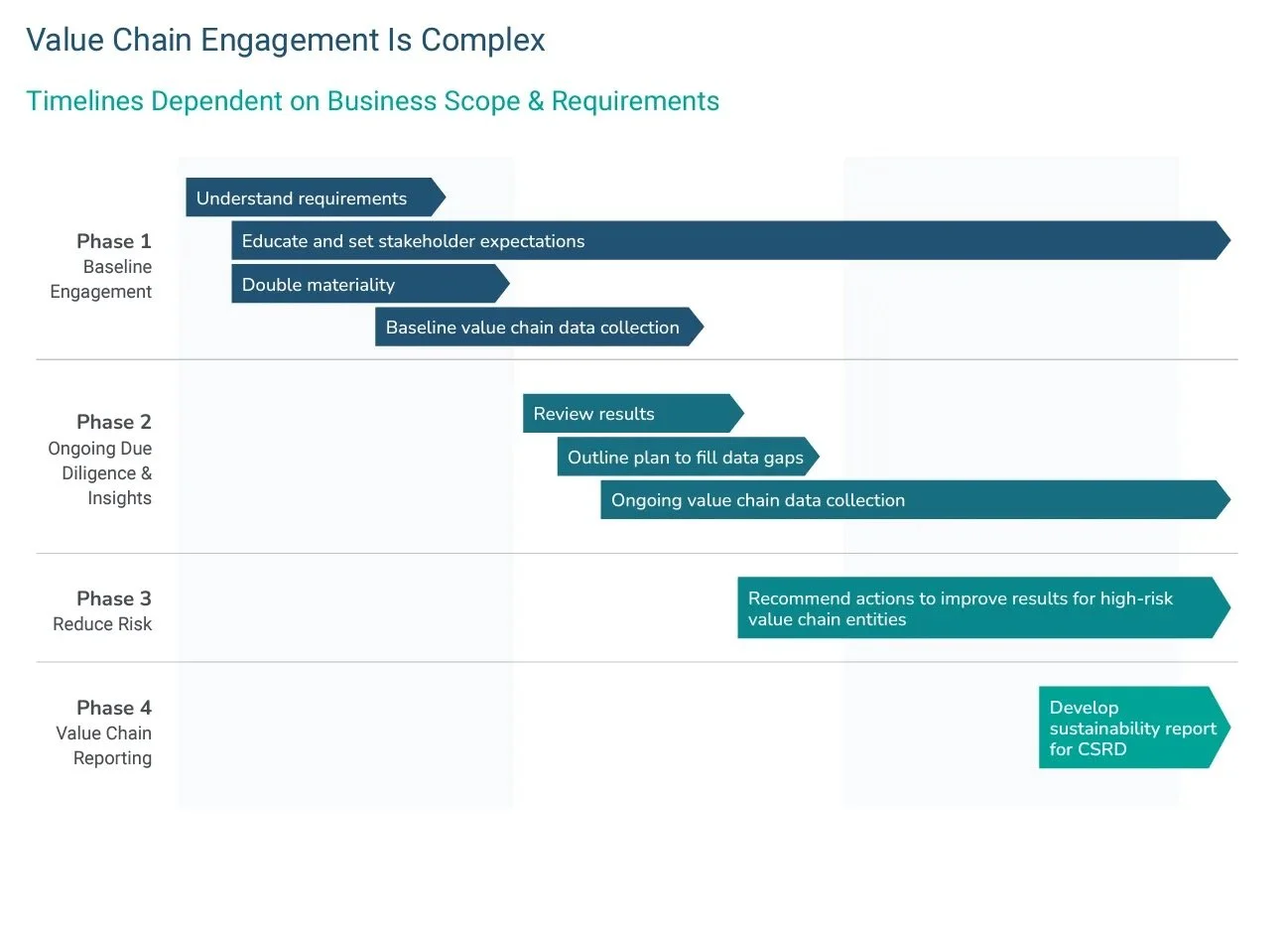

Scope 3 Emissions Emit Complications

This report on EU Double Materiality requirements provides a great roadmap for Australian businesses wanting to understand their exposure to Scope 3 emissions, and illustrates that EU regulations will expand into other jurisdictions:

“Finally, by 2029, large non-European companies with at least one subsidiary in the EU that qualifies as a large business or a public-interest SME will be required to start reporting for the 2028 financial year. It is important to note that large U.S.-based companies with branches in the EU that met CSRD reporting criteria in earlier years might need to report before 2029.”

Source: Assent - CSRD Risks: Transforming ESG Reporting Challenges into Business Advantages

1 Thing For You To Ponder

Companies don’t need to stay within the confines of a 100-page PDF for their Sustainability reporting. Having the reporting in line with ISSB/ASRS requirements is a non-negotiable, but a little bit of production effort goes a long way to show just how seriously organisations are taking their commitments and responsibilities.

Dexus released the below a few weeks ago, and as you will see, the CEO & Managing Director, COO and Head of Sustainability all speak to how Sustainability is integrated within their core operating model. Easy-to-digest results of their climate and social impact, underpinned by their customer-centric approach.

I expect we’ll be seeing a lot more of these evidence-based videos as companies look to double down on the competitive advantages borne from their Sustainability undertakings.

Until next week,

Dan